Interest Rates Taking a Toll on the U.S. Housing Market

We are seeing victims of higher interest rates emerge. And one such victim is the U.S. housing market.

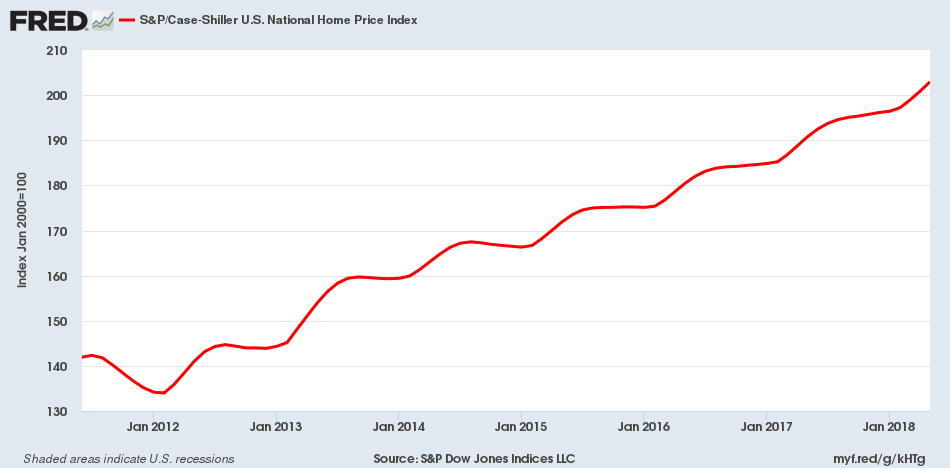

If you watch the mainstream media, it will show you charts like the one posted just below. It’s the S&P/Case-Shiller U.S. National Home Price Index, which tracks home prices in major cities in the United States. Mainstream audiences will likely be told that, since home prices have gone higher, there is no need to panic.

(Source: “S&P/Case-Shiller U.S. National Home Price Index,” Federal Reserve Bank of St. Louis, accessed July 31, 2018.)

It’s important to look beyond this and not judge a book by its cover. On the surface, the U.S. housing market may look good, but interest rates are impacting it already. Prices haven’t fallen yet, but sales and construction are taking a hit.

Also keep in mind that the S&P/Case-Shiller National Home Price Index is a lagging indicator; it tells us what has happened, not what could be ahead.

Home Sales and Construction Tumble

Home sales are declining. In June 2018, sales of existing (already built) homes declined by 0.6% from a month earlier. Year-over-year, sales declined by 2.2%. (Source: “Existing-Home Sales Subside 0.6 Percent in June,” National Association of Realtors, July 23, 2018.)

In April 2018, new home sales in the U.S. declined by 4.6% from the month prior. There was a slight pickup in sales in May, but then in June, a month-over-month slump of 5.3% occurred. (Source: “Monthly New Residential Sales, June 2018,” U.S. Census Bureau, July 25, 2018.)

Home construction in the U.S. has been severely impacted, too. In April 2018, construction of new homes declined 3.8% from a month earlier. It picked up slightly in May, but in June, it plunged 12.3% year-over-year. (Source: “Housing Starts: Total: New Privately-Owned Housing Units Started,” Federal Reserve Bank of St. Louis, accessed July 31, 2018.)

April to August tends to be the hottest period for the housing market. But right now, this is not the case, with the housing market being anything but hot.

Here’s the kicker: things could get worse. You see, mortgage rates are highly affected by the interest rates that the Federal Reserve sets. Thanks to higher interest rates by the Fed, mortgage rates have skyrocketed, hurting affordability for many Americans.

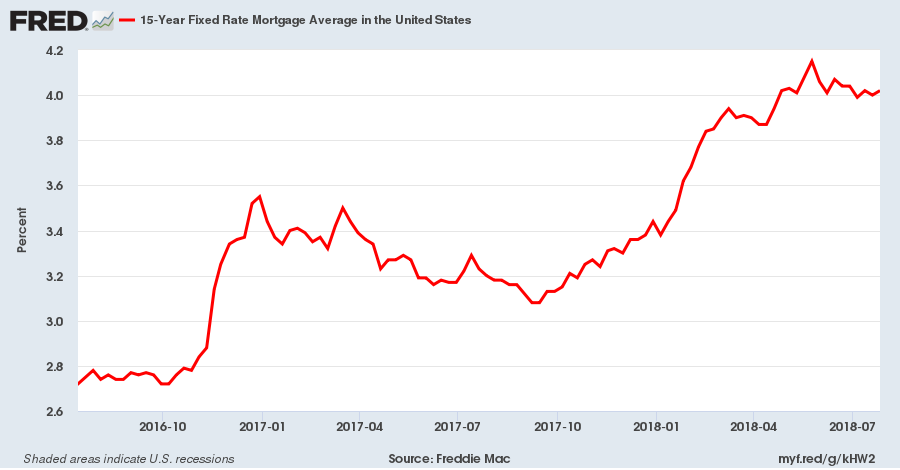

(Source: “15-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, accessed July 31, 2018.)

The above chart plots 15-year fixed mortgage rates. In July 2016, this rate was around 2.8; now it’s above 4.0%. In other words, mortgage rates have soared by more than 46% in a matter of two years.

Why Worry About the Housing Market?

Interest rates are expected to go even higher, so it won’t be shocking to see the U.S. housing market get worse. After all, high interest rates essentially make homes unaffordable for many Americans.

The housing market is an integral part of the U.S. economy. Not only does it employ a lot of Americans, but it also supports several other industries. For example, if more homes are sold, chances are that more furniture and appliances will be sold as well, adding to U.S. gross domestic product.

That means, if the U.S. housing market falls, it will harm U.S growth rates.